The Need for “Implementable” Trade Policies in Africa

In recent years, the importance of rice in Nigeria, and indeed West Africa’s, economy and politics is clear for all to see.

On paper, Africa’s policy is to be self-sufficient on food. However, the implementation has been a different story. While some countries pursue a food self-sufficiency by supporting backward integration, others have been increasing their imports of food items from Asia (China, India and Thailand) and South America (Brazil).

This resulted in tensions between some countries on the continent. The most visible one is in the Economic Community of West African States (ECOWAS), the West African political and trading union block.

Nigeria started its “rice revolution” in 2015. The Nigerian Government, through various monetary and fiscal policies, supported its farmers and millers to produce and process local rice while penalising and restricting importers. Nigeria introduced levies and foreign exchange restrictions on food imports while providing concessionary loans and tax incentives to farmers and investors setting up food processing facilities. According to the Rice Processors Association of Nigeria (RIPAN), the number of integrated rice mills in Nigeria increased from less than 10 in 2015 to over 40 by October 2020 while local paddy production has also increased.

In August 2019, Nigeria closed its land borders with two of its neighbours – Republic of Niger and Republic of Benin. Nigeria accused these countries of undermining its food security programs by allowing, and sometimes supporting, the smuggling of food items (mainly rice and poultry products) through their territories into Nigeria. According to the Nigerian authorities, food items are imported into Benin’s seaport of Cotonou, thereby evading the levies put in place at Nigerian ports, and illegally smuggled into Nigeria through its large and porous land borders with Benin (over 800km) and Niger (over 1400km).

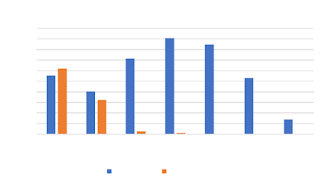

Thailand is one of the largest exporters of rice to Africa. According to data presented by the Thai Rice Exporters Association, direct exports to Nigeria dropped between 2014 and 2018 as shipments to Benin Republic significantly increased. In 2019, exports to Benin dropped showing the impact of Nigeria’s border closure while in 2020, the lockdowns because of COVID-19 meant exports to Africa stopped completely.

This impasse has led mixed outcomes for many regional companies such as TGI Group, a pan African conglomerate with operations in Nigeria, Benin, Ghana and Ivory Coast.

According to Farouk Gumel, an Executive Director at TGI, the group’s Nigerian food operations have flourished while their business in Benin, which relies on trade with Nigeria, was adversely impacted by the border closure. Farouk Gumel said “since the border closure, our Nigerian rice and vegetable oil businesses have been growing and creating jobs locally. For Benin, it was initially difficult. But we adjusted our operations by exploring new markets in other West African countries. Now, we have a good balance”.

TGI is now looking to expand both its Benin and Nigeria operations to cater for these new market opportunities that came up due to the border closure. Farouk Gumel said “the ECOWAS trade policy framework is very comprehensive. The problem has always been on implementation. For the first time in a long time, we are seeing Benin, Niger and Nigeria having very honest conversations on working together on implementing policies in a fair and equitable manner.” He adds that “ the African Continental Free Trade Agreement (AfCFTA) secretariat can learn a lot from these discussions. It is always easier to conceive a theory than to implement it in real life”.

Comments

Post a Comment